The importance of reporting

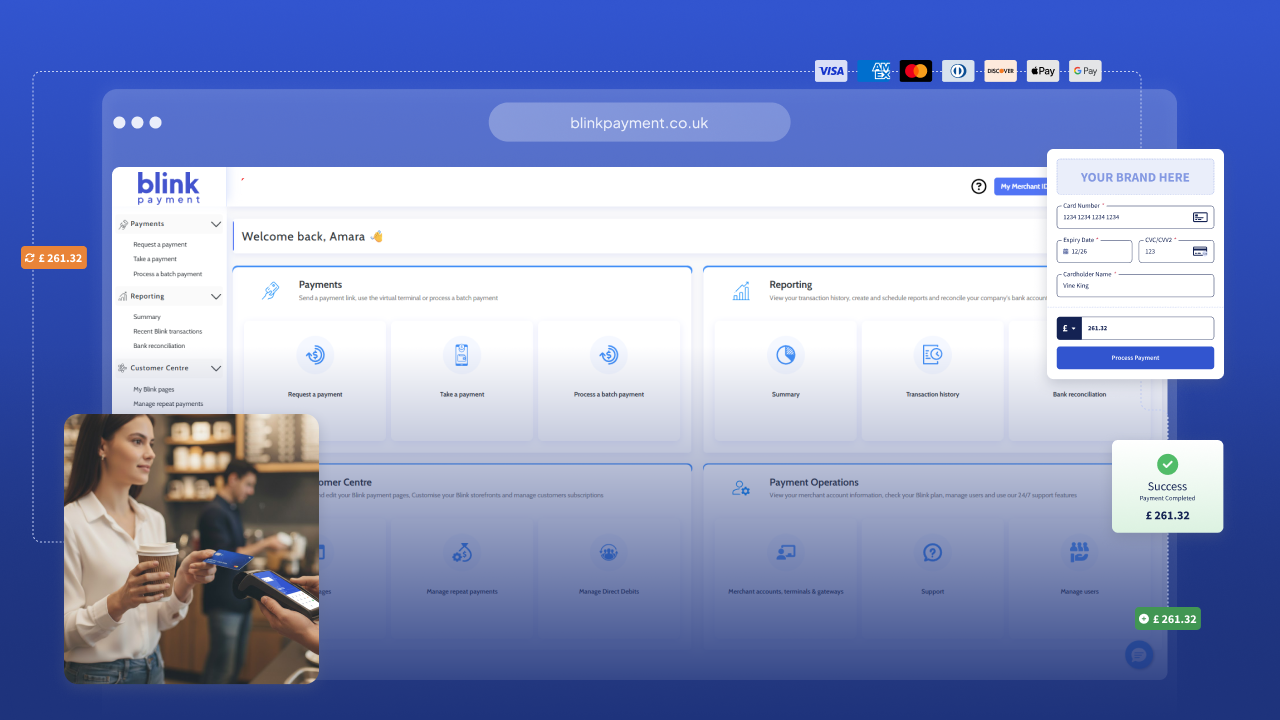

Blink Payment gives you real-time visibility across card payments, direct debits and open banking transactions. Our online portal also gives you access to reports. But why are reports so vital to the smooth running of a successful business?

Here are five overall benefits:

Performance data

Reports provide a clear indication of how your business is performing each month, financially.

Strategic insight

You’re able to analyse trends and make informed decisions about what your next actions should be.

Cash flow management

Reports deliver a complete picture of revenue versus cost and help you reduce risk.

Identifying problems

Issues like unpaid bills, inaccurate settlement reconciliation and late-paying customers can be spotted quickly and addressed.

Improved productivity and accuracy

Compiling precise payment data gives you the information you need to grow your business with confidence.

Discover our robust reporting tools

Reporting isn’t really a ‘bucket list’ item for most people. Perhaps business has been so busy that you keep promising yourself you’ll get around to generating a whole suite of reports sometime soon.

Well, ‘carpe diem’ – seize the day – and check out the following robust reporting tools available to you on Blink Payment:

Recent transactions

This is where you can arrange to have reports emailed to you at specified intervals. Daily, weekly, monthly or on an ad hoc basis for example. You can then customise the reports to suit your needs. Another time-saving feature is the ability to export and use the Blink Payment unique reference(specific to each transaction) to create batch payments.

Scheduled reporting

This is where you can arrange to have reports emailed to you at specified intervals. Daily, weekly, monthly or on an ad hoc basis for example. You can then customise the reports to suit your needs. Another time-saving feature is the ability to export and use the Blink Payment unique reference (specific to each transaction) to create batch payments.

Blink Payment card transactions

With this type of report you can view the history of every card transaction taken via Blink Payment and all other integrated channels that have been processed by your acquirer. Updated every twenty minutes, it’s excellent for monitoring cash flow. Various filter options can be applied to find specific payments with ease. It also provides the data you need to re-run or refund transactions.

Itemised reports

Other items you might like to generate reports for include all card transactions, app payments, open banking and Gift Aid.

The power of reconciliation

Blink Payment bank reconciliation reports list all funded payments received from the acquirer. These can then be broken down into individual transactions and reconciled against your records – including refund and service charge details. Any potential discrepancies can then be quickly identified and dealt with. As bank reconciliation is automated and integrated, therefore administrative errors can be avoided.

Clarity is key, and the reports provide an accurate balance– showing which transactions have been cleared with the bank. All of the data can also be readily exported and integrated into your preferred database format or accounting software.

Take a deep dive into reporting today

Reports help you unlock the potential of your business data. They can help you achieve your corporate goals and growth ambitions by enabling you to make better-informed decisions. Reports and payment analytics help you measure performance and come in a format that is easy to share and discuss with your employees. Budgeting, forecasting and planning for the future can all be handled more efficiently thanks to the power of reports that Blink Payment provides for your business, all in one place.

.svg)

-min.png)

.png)