As the cost of living crisis spirals in the UK, it is no surprise that consumers adjust their behaviour to cope. The question is, how can businesses support and influence buyer motivations through their payment efficiency?

Let's break this down.

The cost of living crisis refers to the fall of disposable income through increased inflation and tax. There have been many environmental factors that have contributed to these unavoidable increases, including the likes of:

- Government policies Tax and National Insurance changes

- Depletion of natural resources Increase in demand and population, causing oil, energy, and food prices to rise

- Economic uncertainty Through Brexit, COVID-19 and depreciation of the pound, importing goods has become more expensive

- Climate change Causing extreme weather conditions disrupting food production

According to PWC 86% of UK adults are concerned about their daily living costs. With such pressures, businesses are witnessing apparent shifts in spending habits as 57% of consumers cut back on non-essential goods. - ONS, September 2022

So, how can businesses overcome buyer behaviour through payment efficiency?

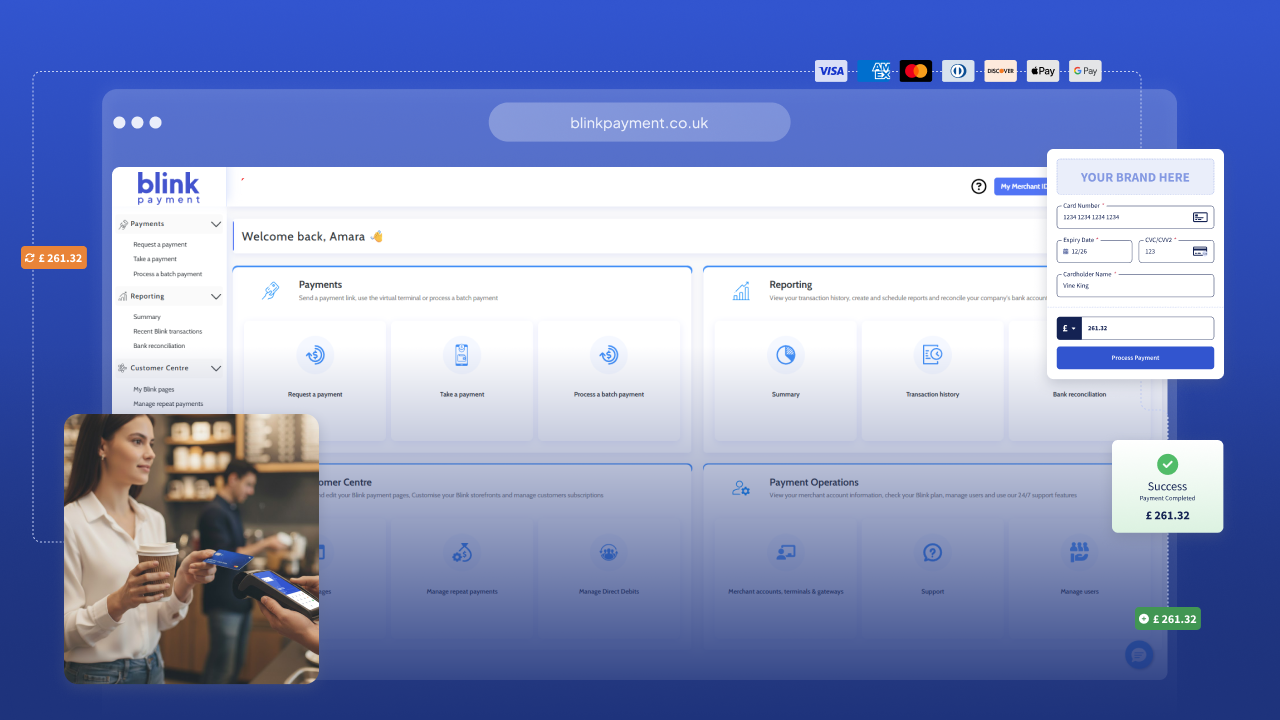

Firstly, it is essential to have options. Ensuring your customers have payment options that best suit their needs will likely influence the purchase. This could be as simple as expanding the types of card that are accepted or allowing contemporary choices such as open banking, payment links or Apple pay. Providing your customers with choices also positively correlates to customer satisfaction and loyalty.

Consider introducing payment in instalments when accepting card to assist your customers. Dividing the payment to help spread the cost of purchasing will aid the consumer's financial stability and budgeting. This can be achieved by setting up repeat payments through fixed or variable payment schedules.

Fixed payment schedules: a set amount is taken at a consistent frequency.

Variable payment schedules: different amounts can be taken at any selected date.

Setting up repeat schedules also aids businesses in streamlining their payment process, as less time and resources are spent when accepting payments. It is efficient and a great way to manage cash flow as it allows for a more predictable revenue stream.

Moreover, with customers becoming considered purchasers, supplying security and brand credibility is essential. Now more than ever, customers will be hesitant to transact through payment methods they perceive as risky.

Branding and customisation throughout the payment journey is significant when encouraging customer confidence. The payment method must look and feel secure whilst also ensuring the correct procedures have been followed to protect your customers.

The risk of financial breaches and fraud would heavily impact their financial stability more so than usual, so supporting this will sustain and strengthen brand credibility.

Lastly, it is vital to create ease. Customers are more likely to purchase when the payment process is quick and easy to navigate. Remember, paying is one of the last interactions your customer has with your brand, and if done right, it will improve repeat purchases.

Additionally, providing faster payment options such as Apple Pay, Google pay, and open banking encourages impulse purchases, which is always a great win!

In conclusion, businesses can adapt to the shift in consumer behaviour through:

- Supplying diversification with payment options

- Setting up repeat payment schedules

- Facilitating secure payment methods

- Having consistent branding, during the payment journey

- Creating a fluid payment experience through quick, easy and simple navigation

If increasing your payment efficiency is on your agenda, reach out to a Blink expert to schedule a call. Blink supports all the methods above alongside other great ways to improve your payment functions.

.svg)

.png)